Welcome to Guru-Goddess. We publish articles and guides for busy women who want to stay in the know and on top of all areas of their busy lives. The word Guru means teacher. Guru Goddess is by women, for women, to empower women. Click on the links to the right to start reading all the articles of interest to you. Empower yourself to transform your life.

Get up and get moving

The best way to stay fit and supple is to get up and get moving, even if it is only for a few minutes a day, several times a day. Try these methods and see how well you start to feel.

Stand and stretch

This gets the blood flowing and muscles moving.

Get 10,000 steps per day

This can all add up as you go through your daily routine. Use a pedometer to keep track. Enjoy a walk after dinner and look for chances to walk up and down the stairs rather than use an elevator or escalator.

Marching in place

This is a more cost-effective option than the standing desk or treadmill desk and can be done anywhere. It works well when when you are talking on the phone so long as you aren’t distracting the other people in the office and are not breathing heavily down the phone at your clients and customers. Wear a pedometer so it counts towards your 10,000 steps per day.

Try yoga

There are many poses to choose from, all of which use the weight of your body to keep you toned and trim.

Ballet

The whole point of ballet is to make smooth and controlled movements that strengthen your arms and legs in particular. Do simple exercises in the office or use your desk or chair as a ballet barre.

There’s no need to pump iron

Use ordinary things around the house as your workout gear. Try bottles of water or cans as light weights. You can also invest in a set of resistance bands, which you can take with you anywhere and use as needed.

Belly dancing

It is fun and good exercise, and gives you a solid core and strong back. It can also help you bring out your inner goddess.

Try these methods in rotation throughout the week and you should never get bored while you get fit.

Getting More Done and Staying Healthier

We all have a busy schedule. The trick is to learn how to get more done and still stay healthy. Here are some top tips.

1. Use a timer

I use a timer for everything in my house. I’ll set the timer for 25 minutes of work, a 5 minute break, then another 25 minutes. I do the 25 minutes 3 times and then give myself a 30 minute break. Then I repeat throughout the day. I try to work 9 to 5 so I don’t get burned out.

2. Wear comfortable shoes

They give good support to help keep you going throughout the day. Give up the high heels and if you are working from home, don’t loll around barefoot.

3. Avoid letting chores pile up for weekends

You deserve some time off with friends and family. There’s no sense in letting laundry, shopping and so on ruin your day off. Get them done during the week. As soon as your machine is full, or your hamper, do the wash. Shop during off times at the supermarket to cut down on crowd and queues.

4. Outsource as needed

You can’t do it all yourself. Outsource a task to someone on fiverr if you can’t do it yourself, you take a long time to do it, or it does not add significantly to your income.

5. Master Make and Freeze Cooking

This method of cooking save time, money and effort. It ensures you will always have something healthy to eat as well, if you choose your recipes wisely. Cook a meal,and freeze the leftovers. Cook one day, and you could have a month’s worth of recipes depending on the size of your family. Not everything freezes well, though, so be sure to get some good books on the subject. Check out the Make and Freeze Spotlight for some suggestions.

6. Work 10,000 steps into your day

This should be pretty easy. Get a pedometer. It will track you throughout the day.

7. Have an Accountability partner

If you set a weight loss goal, for example, have someone like your doctor hold you accountable. It’s one of the main reasons Weight Watchers works.

Try these time saving and fitness tips and see what a difference they make to your health and productivity.

What to do if you are struggling to lose weight

Feet on a bathroom scale – Isolated[/caption]There a number of reasons why people become overweight, but few of them have to do with being ‘greedy.’ In many cases, weight gain is actually the result of confusing information about what to eat and not eat, and what exercise routines work best.

Here’s the secret: The best workout routine? The one you stick to.

The best diet? The one you can live with long term without feeling miserable and starved.

Your starting point should be where you are right now. When is the last time you got on the scale, and what did it say? If the answer is ‘way too much’ and shocked you, it is time to set a target weight goal and start working towards it. Of, if you have a special occasion on your calendar you want to look great for, like a wedding or class reunion, set a target weight or clothing size to reach by the time the event rolls around, and see how great you will look and feel when you achieve your goal.

Yes, it will take work, and losing weight is only part of the process. Adding activity to your day will help you burn the calories you do eat. Lean, toned muscle will burn calories more efficiently than flabby ones. Even if you hate to break a sweat, there are many different activities you can enjoy that will help you firm up your body as you drop the pounds.

You deserve to be your best self. So dust off the scale, get out a little notebook to keep track of it and your target weight and goals, and start adding more activity to your daily routine, even if it is just a walk around the block to start with.

You CAN do it. And here are a couple of suggestions that can help:

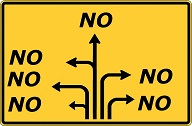

Learning To Say No to Take Better Care of Yourself

If you are like most women, you have probably bee tuaght to be ‘nice’ and a ‘people pleaser’. The trouble with this is that everyone else will be pleased EXCEPT you!

If you are feeling like a pressure cooker about to explode, or as if you are running on an empty fuel tank, it’s time to practice saying NO.

Piling On Stress

Not being able to say no can greatly contribute to elevated stress and poor physical health. Trying to do too much is a fast way to get burned out. It can add to chronic stress, and people who cannot say no are usually the first to fall victim to bad health.

It is important to understand your own boundaries and limitations. While helping others is important, you have to take care of yourself first in order to be able to care for anyone else. This means sometimes saying no to friends and family, in order to maintain an optimal level of health and wellness for yourself.

Feelings Of Obligation

This is by far the most common cause of resentment between people, because they are basically “forced” to say yes whether or not they want to. Maybe the person asking did a major favor for you in life, maybe it is a family member you can’t avoid, but either way, they keep coming to you over and over again.

If this is the case, you need to ask yourself “When have I paid them back in full?” You can make it clear that you appreciate what they did in the past but you’ve done a lot since and are on you own path and mission in life. With so few waking hours in the day, you need to follow your path.

Enabling Behavior

Learning to say no is important so you don’t enable others to commit bad behavior. If you never say no to a child, for example, they will become very spoiled and impossible to deal with.

From friends begging you for a loan to fuel their unnecessary spending, to people asking you to go out drinking with them when you suspect they have an alcohol problem, it is in their best interests to say no, and mean it.

Avoid Suffering in Silence

There have undoubtedly been numerous times when you have sat in silence, suffering and fuming. This is not healthy. You might not be able to control other people, but you CAN control the way you react to others. You might hate confrontation, but sometimes it is the only way to effect positive change in your life.

Conclusion

NO is NOT a bad word. It is actually one of the healthiest choices you can make. You deserve to be your best self and live your best life. That being the case, practice saying it in front of a mirror. No, I’m sorry will give you the freedom you are longing for.

One final point-do NOT give a reason. That would leave the door open to them trying to get around you and make you say yes. Say no, and mean it. End of discussion. You will be a lot happier and healthier once you master this.

Sending Valentine Flowers

Valentine’s Day is a day set aside each year (on February 14th) to say, “I love you”. Usually people consider Valentine’s Day a day for lovers – and it IS a day for lovers but it is also a day to say, “I love you” to other people in your life.

Red roses are the number one (make that only) choice of flowers to send to the lady love of your life. The meaning of the red rose is ‘love and passion’ but roses are available in different colors and each color has a special meaning.

You might send yellow roses to your parents. Yellow roses symbolize warmth and happiness. Your parents provided you with warmth and happiness for all of your growing-up years so you (both sons and daughters) should send yellow roses to parents on Valentine’s Day this year.

If you have a young daughter or a young niece or God daughter that you want to remember on Valentine’s Day, send her white roses. White roses symbolize “purity and innocence”. They are the perfect flower to send to the young girls in your life.

Send pink roses to your grandparents. Pink roses symbolize grace and elegance. Your grandparents are graceful and elegant so tell them that you love them with a bouquet of pink roses on Valentine’s Day.

Different kinds of roses also have significance. A bouquet of petite roses symbolizes affection. Petite roses are also known as sweetheart roses. A single long stemmed rose says, “Thank you” or “Good job”.

Send roses for Valentine’s Day and choose the ones that will deliver the right message to each person in your life that you care about.

Who was Cupid?

One of the most universally recognized symbols of Valentine’s Day is Cupid. Legend has it that Cupid (that winged creature that makes us fall in love) is actually equipped with two kinds of arrows. He has golden arrows which cause true love when they penetrate the heart but he also has arrows made of lead which cause wanton sensual passion.

Cupid is the Roman god of love. He is said to be the son of Venus (the goddess of love) and is usually depicted as a chubby, mischievous child with wings who is armed with a bow and a quiver containing a never-ending supply of golden arrows. He uses the bow to shoot a golden arrow into the heart of the unsuspecting victim causing them to fall in love with the next person they meet.

There is a mythological story that describes how Venus, while playing with her son, is scratched by one of his arrows and then falls instantly and helplessly in love with Adonis…the first man she saw after receiving the wound.

In Greek mythology Cupid is known as Eros and is the winged son of Aphrodite. Cherubs are believed to be the descendants of Eros and they are usually depicted as lovable little winged angles that are not armed with bows and arrows.

If Cupid aims an arrow in your direction this Valentine’s Day, just hope that he uses a golden arrow and not one that was made of lead. Wanton desire ends, but true love lasts forever.

Valentine Sweets to the Sweet

The famous Shakespearean quote, “Sweets to the sweet” is one that often accompanies boxes of chocolates or other candies given to women by the men who love them on Valentine’s Day. On Valentine’s Day this year it is expected, that there will be more than $2.4 million spent on heart shaped boxes of candy. There will likely be more than 36 million boxes of candy sold. Candy is ranked only number two on the list of Valentine’s Day gifts…just behind roses.

So how is it that giving candy as a Valentine gift became a tradition? It is rather hard to say but commercial candy making developed during the early nineteenth century with the advancement of automation and the discovery of sugar beet juice.

The human craving for sweets can probably be attributed to the first caveman who robbed a bee hive. Humans love sweets of all kinds but they especially love chocolate. The rest of the world loves chocolate but Americans REALLY love chocolate. As a matter of fact the very first commercial chocolate factory was built in New England twenty years before the American Independence was declared and the American Revolutionary War was fought. Americans love chocolate and they will consume more than 3 BILLION pounds of it this year.

Chocolate will be the number one selling candy this Valentine’s season. Coming in second are those little pastel colored hearts that are inscribed with love messages. These little hearts are called “conversation hearts” and have such inscriptions as “Luv U” or “Go Away” printed on them.

Yes, “Sweets to the sweet” is what makes the gift of candy such a wonderful and thoughtful Valentine’s Day gift! And who doesn’t love a treat, especially chocolate!